The government’s latest initiative for cash-strapped small businesses struggling to cope with Covid-19 pandemic has gone live and is likely to prove hugely popular.

The Bounce Back loans scheme, announced by Chancellor Rishi Sunak, aims to help tens of thousands of small businesses struggling to secure finance from the Coronavirus Business Interruption Loan Scheme (CBILS), which has been criticised as overly bureaucratic and too exclusive.

Administered by the British Business Bank and the same panel of more than 50 lenders participating in CBILS, the terms of the Bounce Back scheme really are exceptionally generous. Businesses can borrow up to £50,000 at a fixed interest rate of 2.5%, no matter which lender provides the advance (you don’t have to apply to your own bank).

The government guarantees the lender that it will stand behind the loan in full if the business defaults on repayments, which means lenders do not have to waste time conducting credit checks.

A simple standardised application form should also mean loans go through very quickly. Cash could be in companies’ accounts within days of their online applications. Bounce Back loans will be repayable over six years, though early repayments can be made without penalty.

There are no repayments to make in the first year and lenders are not allowed to ask for personal guarantees from the company’s directors. Importantly, while the scheme is aimed at the smallest businesses, the eligibility criteria set no maximum size constraints, whether by number of employees, turnover or balance sheet.

Borrowers simply have to certify they are UK-based, that they’ve been adversely affected by the Covid-19 pandemic, that they’re not currently in bankruptcy or liquidation and that they’re not making use of any other Covid-19-related government loan scheme.

The upshot is that for any business in need of less than £50,000 to see them through the Covid-19 crisis, the Bounce Back scheme is head and shoulders above any of the government’s other initiatives, including CBILS.

And even if you think you may need more than that in the end, Bounce Back is worth considering in the short term; it’s possible that you’ll be able to convert the loans into a CBILS facility later on. Equally, CBILS loans of less than £50,000 can now be converted into Bounce Back finance, which is likely to be a good option for most borrowers.

However, even if you don’t need finance to survive the crisis, don’t overlook this new scheme. The terms are so good that this could be a valuable opportunity to refinance other types of debt, expensive credit-card borrowing or bank loans, for example, or even to finance investment. This is legitimate under the terms of Bounce Back

Motivational Quote Of The Day

“Rule No.1: Never lose money. Rule No.2: Never forget rule No.1.”

Warren Buffett

Alternative Quote Of The Day

“Crime in multi-storey car parks. That is wrong on so many different levels.”

Tim Vine

Money Statistics

31 – The number of tonnes of gold belonging to Venezuela that is held in the Bank of England’s vaults, worth around £1.3bn at today’s prices. The government of President Maduro has asked for some of it to be sold, but the Bank has so far refused. Britain recognises Juan Guaidó, the opposition leader, as the legitimate president of Venezuela.

61 – The percentage of investors and business owners with investable assets or annual revenues of at least $1m who are waiting for stocks to fall by 5% to 20% before buying shares again.

Today’s National Day

NATIONAL WORLD BARTENDER DAY!

PUBLISHERS NOTICE

Dear Streetwise Customer,

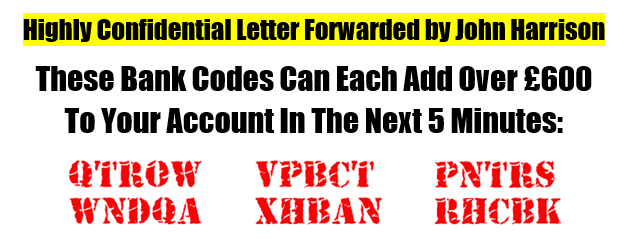

It didn’t come as a surprise to me when 2 banks intervened and literally blocked their customers from hearing from me, even though everything I was saying is 100% legal.

That’s because I’ve been exposing how the banks constantly take advantage of the little guy.

But now the tables have turned…

I doubled my money by legally intercepting unofficial bank messages.

But the best part is that banks can’t stop us from milking this over and over again!

And now I’m giving you the opportunity to copy me…

Just give me a few minutes of your time.

I’ll explain all of this when you visit:

www.streetwisenews.com/code

Kind Regards,

Jim Hunt